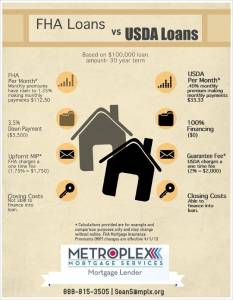

Home loan credits from the US Division of Agribusiness (USDA) and Government Lodging Organization (FHA) are by and large simpler to fit the bill for than a traditional home loan. This makes them great alternatives for first-time homebuyers and low-to direct pay borrowers.

While both of these credits are upheld by government offices, there are a few critical contrasts between the two that you’ll have to consider prior to applying for one. For example, USDA advances expect you to live in a rustic drawing and meet your region’s pay line.

Here is a more critical gander at each credit program so you can choose which one best meets your requirements:

- USDA versus FHA qualification

- USDA versus FHA versus traditional

- USDA upsides and downsides

- FHA upsides and downsides

USDA versus FHA qualification

The USDA and FHA both deal home credits for single-family homes.

For a FHA advance, you’ll apply for a 203(b) fundamental home loan advance to buy your main living place.

In any case, there are two USDA home credit projects to browse and the qualification guidelines are somewhat unique:

USDA Ensured Credit: For low-to direct pay families that a private bank issues yet the USDA backs. You will not have a getting breaking point or property limitations for this advance.

USDA Direct Advance: For low-and exceptionally low-pay borrowers that need extra endorsing. The USDA supports the advance and it has stricter pay and property capabilities. Likewise, as far as possible is $285,000 in many districts.

USDA home credits have stricter pay limits than FHA advances and furthermore expect you to live in a qualified provincial region. Your street number and yearly family pay decide your borrower qualification for USDA credits.

FHA borrower prerequisites, then again, are more indulgent as you can have a lower FICO rating. Multi-unit properties are likewise qualified. Notwithstanding, you’ll need to make an initial installment with a FHA advance.

USDA versus FHA versus traditional

Numerous homebuyers will utilize a USDA, FHA, or traditional home loan to buy their home. Here is a more intensive glance at how these three advance sorts contrast.

USDA credits

These credits are simply accessible to country homebuyers with low or moderate earnings. As far as possible shift by area yet are somewhat severe. USDA advances don’t need an initial investment however you’ll require a base FICO rating of 640 and need to pay a forthright 1% assurance expense in addition to a yearly charge equivalent to 0.35% of your credit sum.

FHA advances

Of the public authority contract programs, you might have the simplest time fitting the bill for a FHA credit. You’ll possibly require a 3.5% up front installment when your FICO rating is something like 580.

So, you’ll doubtlessly pay contract protection for the existence of the credit except if you can put down basically 10%. Doing this permits you to postpone your excess installments following 11 years.

Standard mortgages

Regular home loans have the strictest credit prerequisites yet they additionally offer serious rates and can wind up being less expensive over the long haul. For instance, you can keep away from private home loan protection with a base 20% up front installment.

Solid doesn’t offer FHA or USDA advances, however we can assist you with tracking down an incredible rate on a standard mortgage. Essentially enter some fundamental monetary data, and you’ll see a few prequalified rates in minutes. From that point onward, you can investigate your advance choices and observe one to be that best accommodates your spending plan.

USDA advantages and disadvantages

USDA credits offer a few benefits for borrowers, yet you’ll have to think about a portion of the disadvantages also.

USDA aces

Here are probably the best motivations to consider a USDA credit:

- No base up front installment: Standard mortgages and FHA credits both interest some type of initial investment, however USDA advances have no such prerequisite.

- May not require cash holds: Loan specialists may not need cash stores to get financing. Notwithstanding, including your passing adjusts may make it simpler to qualify.

- No set most extreme price tag: USDA credits don’t have a getting limit. All things considered, your most extreme advance sum relies upon your reimbursement capacity.

- Lower contract protection expenses: Your forthright USDA ensure charge is 1% of the advance sum and the yearly charge is 0.35%. The two rates are lower than the FHA contract protection expenses.

- Vender can pay shutting costs: The dealer can contribute up to 6% of the business costs. You can likewise get limitless gift assets to decrease your advance sum.

USDA cons

These are the primary hindrances of this advance program:

- Great credit required: You’ll need a base 640 FICO rating to be qualified for this advance, like traditional loan specialists. FHA banks may just require a score of 580 or less.

- Geographic limitations: You should live in a rustic region to fit the bill for USDA financing. Fortunately, the definition is adaptable and numerous rural and room networks can be qualified if the populace is under a specific sum.

- Greatest pay limits: For a USDA Ensured Advance, your family pay can’t surpass 115% of your district’s middle family pay (MHI). Families with a pay 80% beneath the MHI should apply for a USDA Direct Advance. Direct Credits can have stricter property and application necessities be that as it may, as Ensured Advances, they don’t need an initial investment.

- Lifetime ensure expense: All USDA advances require a forthright and yearly assurance charge for the existence of the advance. In contrast to FHA and standard mortgages, making a passing initial installment will not have any impact on whether you’ll pay contract protection.

- Single-family homes as it were: Single-family homes are the main qualified property type. This incorporates apartments and condominiums, as long as you utilize the unit for your main living place. Speculation properties are ineligible.

FHA upsides and downsides

FHA advances are a decent alternative, particularly on the off chance that you have low credit or a ton of obligation. Be that as it may, they accompany their own arrangement of disadvantages as well.

FHA geniuses

The absolute best motivations to apply for a FHA home credit include:

Permissive credit necessities: You can by and large fit the bill for most extreme FHA financing with a FICO assessment of 580 versus a 640 score for a USDA advance. You may likewise be qualified with a FICO rating somewhere in the range of 500 and 579 on the off chance that you can make a 10% initial installment.

Higher relationships of outstanding debt to take home pay: Your back-end DTI — that is, your all out month to month obligation commitments — can be pretty much as high as 45% for FHA credits, however just 41% for USDA advances.

Possibly lower financing costs: FHA loan fees can be lower than rates for USDA advances since you have the choice to pick more limited reimbursement terms, including a 15-year fixed loan cost. The USDA just offers 30-year fixed advances, which normally have higher rates.

Multi-nuclear families can qualify: Properties with up to four units can fit the bill for financing with a FHA advance when one unit is your main living place. For instance, buying a duplex with a FHA advance is permitted as long as you live in one portion of the property. Like USDA advances, notwithstanding, second homes and speculation properties are ineligible.

FHA cons

- Higher initial installment prerequisites: Contingent upon your financial assessment, you’ll need to make a 3.5% or 10% up front installment. USDA advances require no initial investment.

- Higher home loan protection charges: Your forthright and yearly home loan protection expenses are higher than the USDA ensure expense and yearly charge.

- Hard to drop contract protection: You’ll pay a yearly home loan protection charge for the existence of the credit except if your initial installment is basically 10% — in which case, you’ll just compensation contract protection for the initial 11 years.

- Home loan restricts: The greatest credit sum in 2021 is $356,362 for most regions. You can meet all requirements for a higher breaking point on the off chance that you live in a significant expense region.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No House Loan Guide journalist was involved in the writing and production of this article.